Get To Know 2024’s Top Dealers

Fully stocked, dealers focus on moving their community forward, plus adding services and square footage to better serve operators.

Participants of the FER 2024 Top Dealers Report gave 2023 mixed reviews. For some, it was challenging as sales revenue dropped after several years of major growth. For others, it was a year like any other. But every dealer FER spoke with agreed on one thing: Inventory levels have stabilized.

Gene Clark

“This idea of scarcity of products where you’re scouring the country for a fryer, that’s just not the case anymore. We all know that it was in the years preceding,” says Gene Clark, CEO of Clark Associates, ranking No. 1. “The industry is back in stock and because of that, everyone’s seeing customer behavior shift. We saw customer behavior shift in the world of scarcity, and now we’re seeing a return to normal, if you will.”

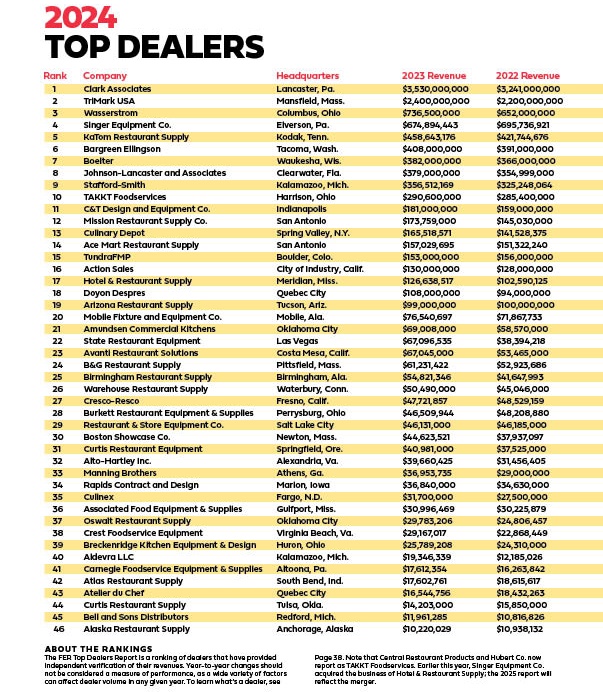

Overall, 36 of 46 participating dealers in the 2024 report posted an increase in sales, compared to 44 of 46 dealers in the 2023 report. The two reports feature a slightly different mix. Notably, Edward Don & Co., typically ranking No. 3, moved out of the report (see “Where’s Don?” below).

Cumulatively, participants reported sales of $11.9 billion in 2023, up 8.5% from 2022. State Restaurant Equipment saw the biggest boost last year, growing sales nearly 75%, from $38.4 million to $67.1 million, as a result of two hotel openings, says President and CEO Scott Miller.

To compare, in the past couple years, dealers have posted combined sales increases of more than 26% (2023 report) and almost 30% (2022 report) after dropping nearly 17% (2021 report). In the 2020 report, which posted 2019 revenue (the last numbers before the pandemic), combined sales increased about 8%.

Armed with a proactive mindset, and with less pandemic-induced chaos, participants are working on moving the dealer community forward as well as their own businesses—all of which benefit operators.

KaTom Restaurant Supply has added a slew of services, says Patricia Bible. The dealership has added everything from virtual reality design services to a KaTom credit card. Meanwhile, Bible serves on FEDA’s Advocacy Council to help support the dealer community. Issues on deck include tax legislation and AI.

Visiting Capitol Hill

Patricia Bible

Patricia Bible, founder, president and CEO of KaTom Restaurant Supply, and David Stafford, president and CEO of Stafford-Smith, ranking No. 5 and No. 9 respectively, hold roles with FEDA. In March 2024, Bible, who chairs FEDA’s Advocacy Council, spent several days with association members on Capitol Hill. The group talked top-of-mind issues with senators and representatives.

Bible says the expiration of the Tax Relief for American Families and Workers Act of 2024 stands out as a top concern. “It’s going to be far-reaching and far-affecting to every one of us, whether you’re a business or an individual,” Bible says. “If we don’t get that solidified and worked out to where we’re not going to get piled on with a tremendous amount of additional taxes, it’s going to affect the take-home, which is going to affect how we as business owners can invest back into our companies, our communities, our country.”

Gas bans, immigration and artificial intelligence also were on the agenda.

David Stafford

Meanwhile, Stafford, who serves as chairman of the FEDA board of directors, says one association highlight in 2023 was the establishment of two councils. The Future of Distribution Council comprises dealers and manufacturers who come together to talk about the industry’s current and future needs, while the Small Dealer Council ensures those with fewer resources aren’t left behind.

“It’s been very positive,” Stafford says of the first Future of Distribution Council meetings. “It’s about sharing how we as dealers and vendors can get through some roadblocks in the industry and how we can do things that would be better for the industry as a whole.”

Back home, Bible and Stafford work to grow their companies as well.

KaTom announced in 2023 it was on pace to reach a half-billion dollars in sales for the first time; it will reach the goal this year. Most recently, the dealership has added virtual reality design services, digitized its project management solutions and realigned its customer solutions for better flow. It also rolled out a KaTom credit card, and started offering leasing and financing options and warranty extensions.

Building the next generation marks a focus at Stafford-Smith, where many new hires are millennials or part of Gen Z. Stafford is the third-generation owner and his oldest son, David, now works at the business as an account executive on the chain side. Going forward, Stafford says, the dealership will prioritize staying on top of best practices, continuously improving and taking care of customers.

David Stafford points to the leasing of 136,000 square feet (now stocked) at an industrial facility in Oklahoma City as a 2023 highlight for Stafford-Smith.

Adding Square Footage

At least three participating dealers—Stafford-Smith, Clark and Ace Mart Restaurant Supply—worked on developing their physical infrastructures in 2023. Stafford-Smith leased 136,000 square feet at an industrial facility in Oklahoma City. Clark continues to ramp up its new Lebanon, Tenn., distribution center, which FER first reported on in March 2023, and aims to open it this year. Meanwhile, Ace Mart, coming in at No. 14, expanded its footprint when it picked up Wichita Restaurant Supply and Big Plate Restaurant Supply, both

located in its home state of Texas.

Clark’s Lebanon facility represents a large investment in automation and infrastructure. “We’ve always invested in the business but we’re in a very high investment period right now because of the growth we’ve had in the past and just the opportunities we’ve had,” Clark says about the company overall. Ensuring those investments perform as expected is a focus in the coming year, as is understanding the latest customer buying habits.

Clark says the world order of pricing has been on a roller coaster for several years. In the pre-pandemic era, customers had been trained to understand how various manufacturer brands’ pricing stacked up against each other. But post-pandemic, due to transportation cost spikes, rising labor costs, raw material fluctuations and how manufacturers play all these factors into their pricing decisions, the customer has seen the status quo move around several times, and their buying decisions have followed suit.

Ace Mart operates primarily a cash-and-carry model and has 17 retail locations across Texas. The acquisitions will help it reach new customers and expand its services, says Jonathan Gustafson, president of Ace Mart, who like Stafford serves as a third-generation owner.

Jonathan Gustafson

“We’re reaching markets that we were struggling to reach in the past, so now we have better physical infrastructure to serve the west and further north Texas,” Gustafson says. “We really want same-day or next-day fulfillment in our respective regions.”

Gustafson says operating as efficiently as possible marks a goal for the coming year, especially since costs continue to go up.

“Operators are strapped and stressed with the economy,” Gustafson says. “We’re trying to make the right investments that help us be as efficient as possible, whether that’s a new ERP that helps us make better inventory decisions and pricing decisions, or the physical infrastructure to cut down on shipping expenses that we can then pass along to our end-users. We’re exploring ways to make us a leaner, meaner organization.”

-Additional reporting by Christine Palmer

Jonathan Gustafson says Ace Mart Restaurant Supply will focus on finding ways to operate as efficiently as possible in the coming year. In turn, he says, the dealership will pass savings to operators. Ace Mart has 17 stores in Texas. Acquiring two companies—Wichita Restaurant Supply and Big Plate Restaurant Supply—has allowed it to expand its reach across the state.

Where’s Don?

Edward Don & Co. announced in October it had entered an agreement to be acquired by Sysco Corp. By November, the deal closed. As a result of the acquisition, Don doesn’t plan to share its 2023 sales revenue, so it has moved out of the FER Top Dealers Report.

FER only includes dealers who verify their sales revenue, which is usually done through a signed letter or signature of a CPA or other independent accountant. This way, operators, consultants and others know the numbers are credible. (Keep in mind dealers have a host of legitimate reasons for choosing not to report sales revenue.) FER also doesn’t include broadliners (see “What’s a Dealer?” below). FER rankings aren’t intended to be comprehensive, but many dealers capable of serving multiunit operators are listed.

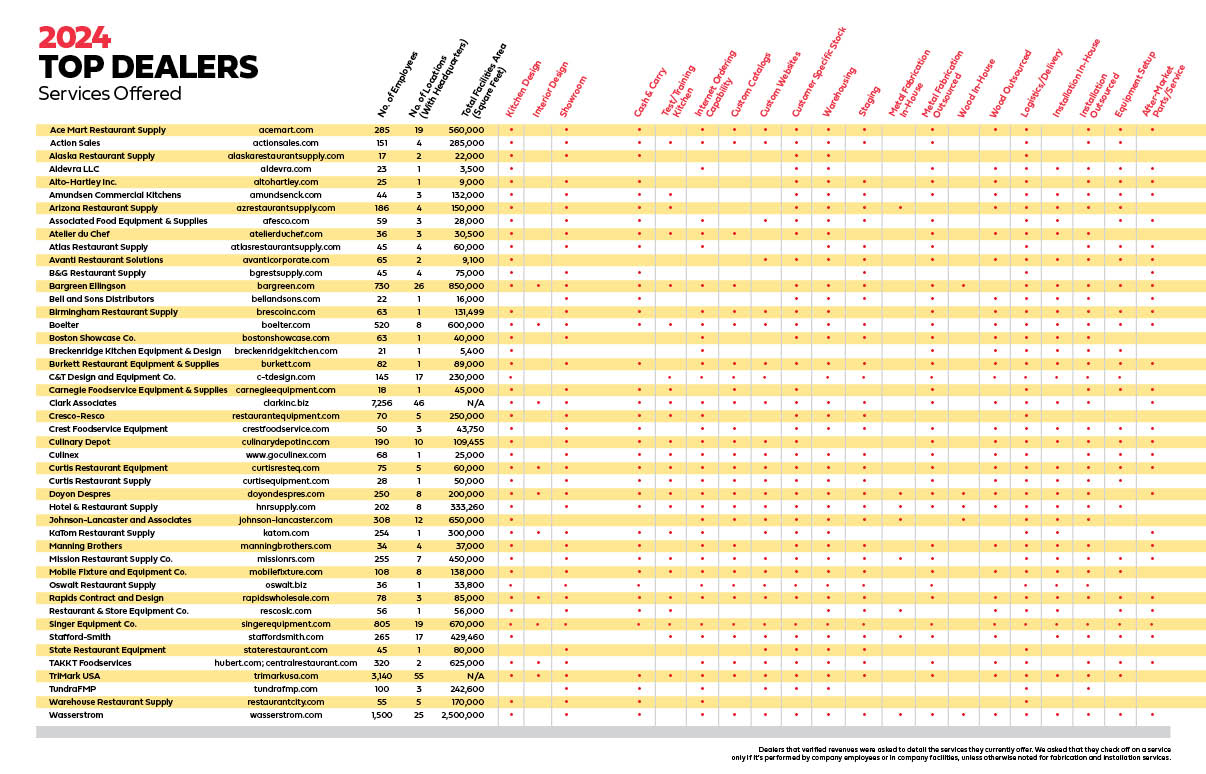

To entice dealers to participate, and as a service to operators, the report, which began in 2011, typically lists their services offered. After a brief break, FER brought the listings back (see below).

What’s a Dealer?

For the FER Top Dealers Report ranking above, FER uses the following criteria: To be ranked, the dealer must independently verify its volume. This is usually done with a letter or signature from a CPA. If more than 50% of a distributor’s sales are from paper, chemicals and other nondurables, FER does not include them. This excludes nearly all broadline distributors and paper distributors that have significant equipment and supplies volume.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -